property tax assistance program nj

For more information call 800-882-6597. NJ Division of Taxation - Local Property Tax Relief Programs.

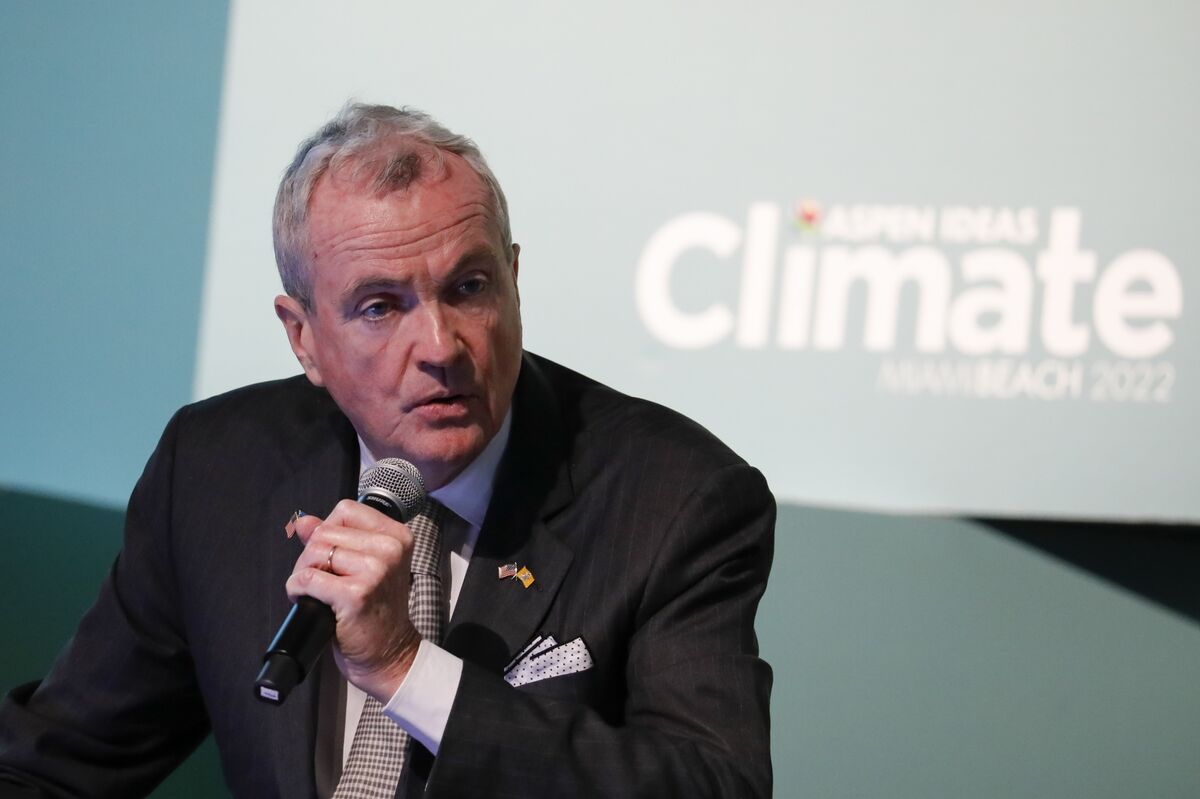

Gov Phil Murphy Announces Expansion Of Anchor Property Tax Relief In New Jersey Cbs New York

The Free File Alliance allows commercial income tax software providers to offer free tax filing services to qualified taxpayers.

. New Jerseys Property Tax. One way of saving a penny or two is by applying for NJ property tax relief programs such as. Property tax assistance program nj.

Eligibility Requirements and Income Guidelines. Call NJPIES Call Center. 2021 94178 or less.

All property tax relief program information provided here is based on current law and is subject to change. NEW JERSEY If you like many others have been financially hit by the pandemic and are lagging behind in mortgage and property tax payment theres help coming your way. Civil Union Act Implementation.

To qualify you must meet all the eligibility requirements for each year from the base year through the application year. You also may qualify if you are a surviving spouse or civil union partner. Heating assistance rebates will be issued starting on october 18 2021.

If you dont have internet access you can call 855 647-7700 and if you need additional assistance you can contact a housing counselor in your area or email HAFservicingnjhmfagov. If your income was between 100000 and 150000 the credit is your property tax multiplied by 5. The Homestead Benefit Program.

Ad Search For Info About Nj property tax relief. New Jersey has introduced the Emergency Rescue Mortgage Assistance ERMA program that will give up to 35000 to eligible homeowners who have been unable to pay their housing bills due. As one of the most expensive states to live in NJ citizens may need help paying property taxes to keep up with the high cost of living.

Forms are sent out by the State in mid-April. The house was your primary residence not a vacation home second home or investment. Your 2017 property taxes were paid in full.

Local Property Tax Forms. Approved Software Providers Commercial software available from software providers. For information call 888-238-1233.

Some programs allow the creation of property tax installment plans for property owners who are delinquent in paying taxes as a result of saying being unemployed for the last several months. Property tax assistance program nj Saturday July 9 2022 Edit. You were a New Jersey resident.

If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction. To be eligible for 2021 property tax relief in New Jersey via the Homestead Benefit Program you must meet all the following requirements. Local Property Tax Relief Programs.

Homestead Benefit Program. TransAction Portal TAP Businesses Alcoholic Beverage Licensees and Livestock Owners can file and renew most account types through TAP. The Homestead Benefit program provides property tax relief to eligible homeowners.

Applicants may receive up to 35000 per household to cover. Nj Property Tax Relief Program Updates Access Wealth. And Your primary residence whether owned or rented was subject to property taxes that were paid either as actual property taxes or through rent.

The Boards other functions include the annual production of the Abstract of Ratables the Equalization Table of Assessments for the purpose of county taxes the supervision of Municipal Tax Assessors and the certification of municipal tax rates. Stay up to date on vaccine information. Deductions exemptions and abatements.

Property taxes must be paid in full for the years applied for by June 1st of the following year. The state has two programs that are supposed to help seniors with the costs. Edison senior services provide a wide variety of services to senior residents of edison township.

New Jerseys Emergency Rescue Mortgage Assistance ERMA program provides financial assistance for eligible homeowners who have experienced a significant decrease of income or increase of expenses due to COVID-19 and have been unable to remain current with their mortgage payments. Any negotiated program will be effective after the local government officials have thoroughly reviewed the owners ability to pay and the request from the homeowners. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes.

Kiely said if your 2014 income was 100000 or less your rebate is your 2014 real estate tax multiplied by 15 percent with a maximum rebate of 1000. General qualifications are as follows. Senior Freeze Property Tax Reimbursement The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence main home.

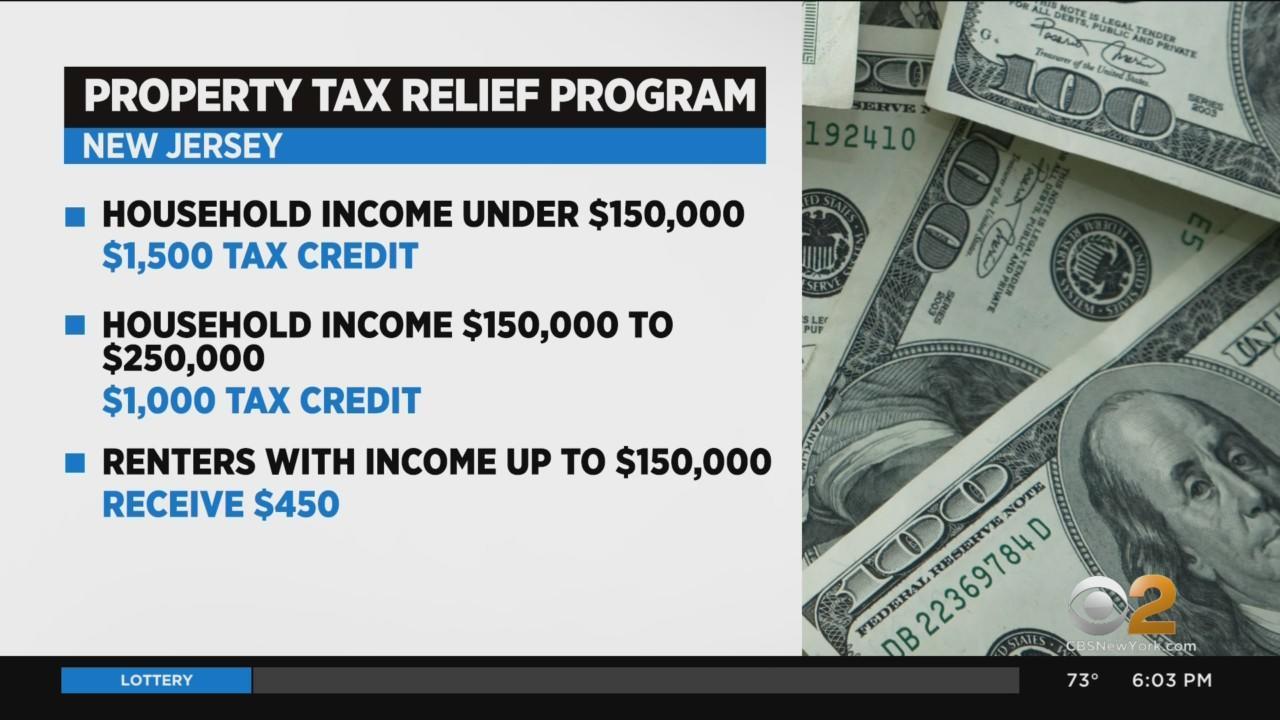

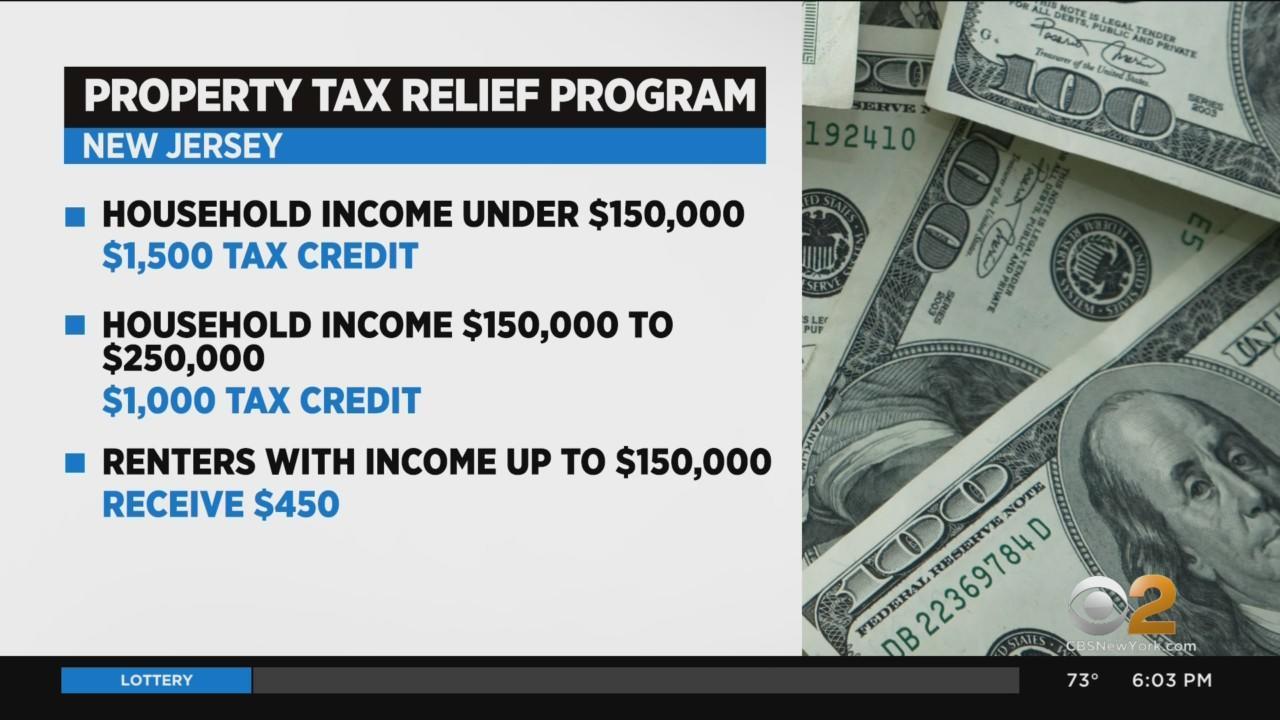

You owned and occupied the home on October 1 2017. The Mercer County Board of Taxations primary responsibility is the certification of property tax assessments. The property tax rebates for homeowners would be boosted to 1500 and renters would get 450 checks to offset rent increases related to property taxes.

NJ Mortgage Property Tax Relief Program Coming Amid COVID Emergency Rescue Mortgage Assistance program will give up to 35000 to those who have been unable to pay housing bills due to COVID-19. United Way of Hunterdon County is providing free assistance to those wishing to file for the NJ Senior FreezeProperty Tax.

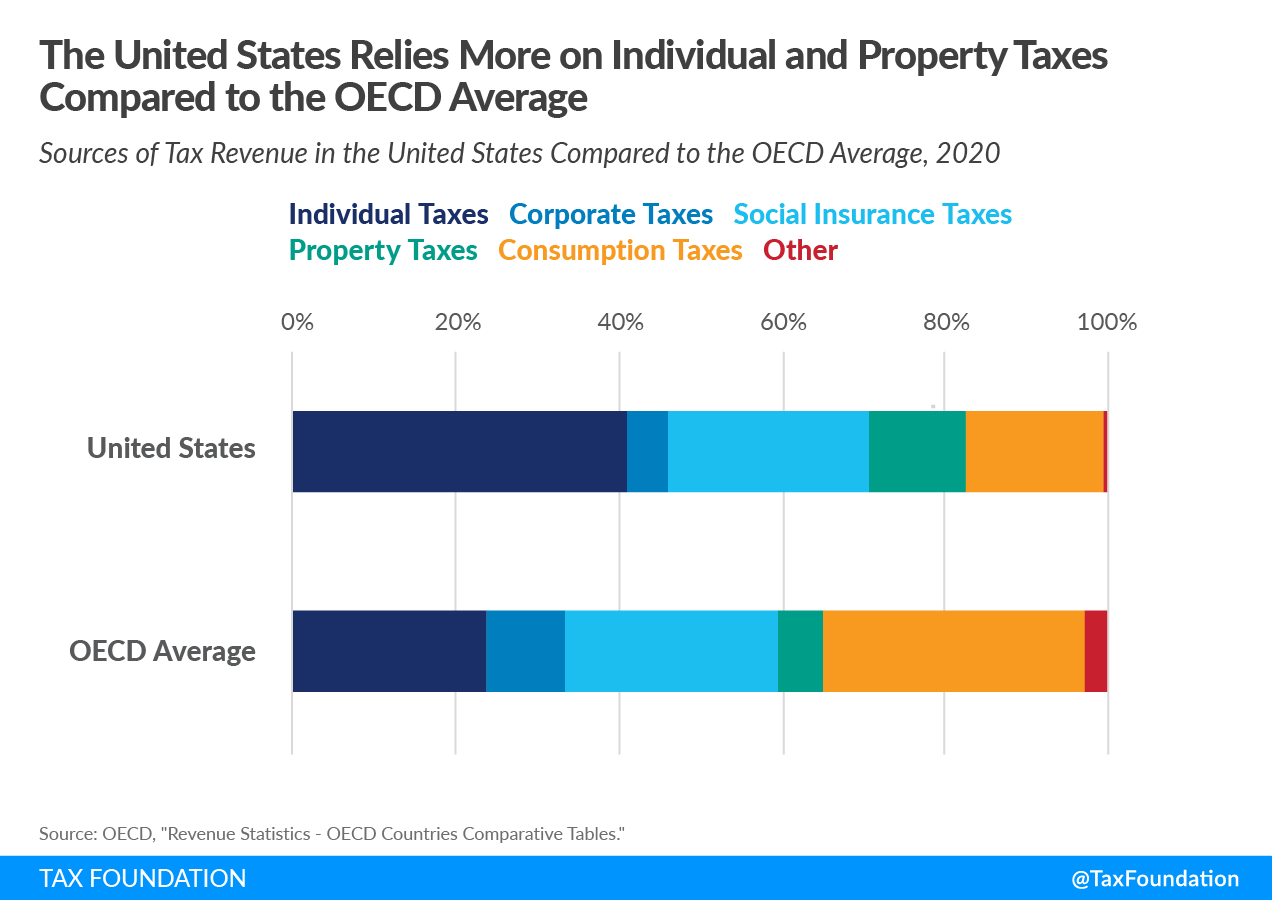

Property Taxes Property Tax Analysis Tax Foundation

Property Tax Relief I Ve Got A Proposition For You Governor Mulshine Nj Com

Property Taxes Property Tax Analysis Tax Foundation

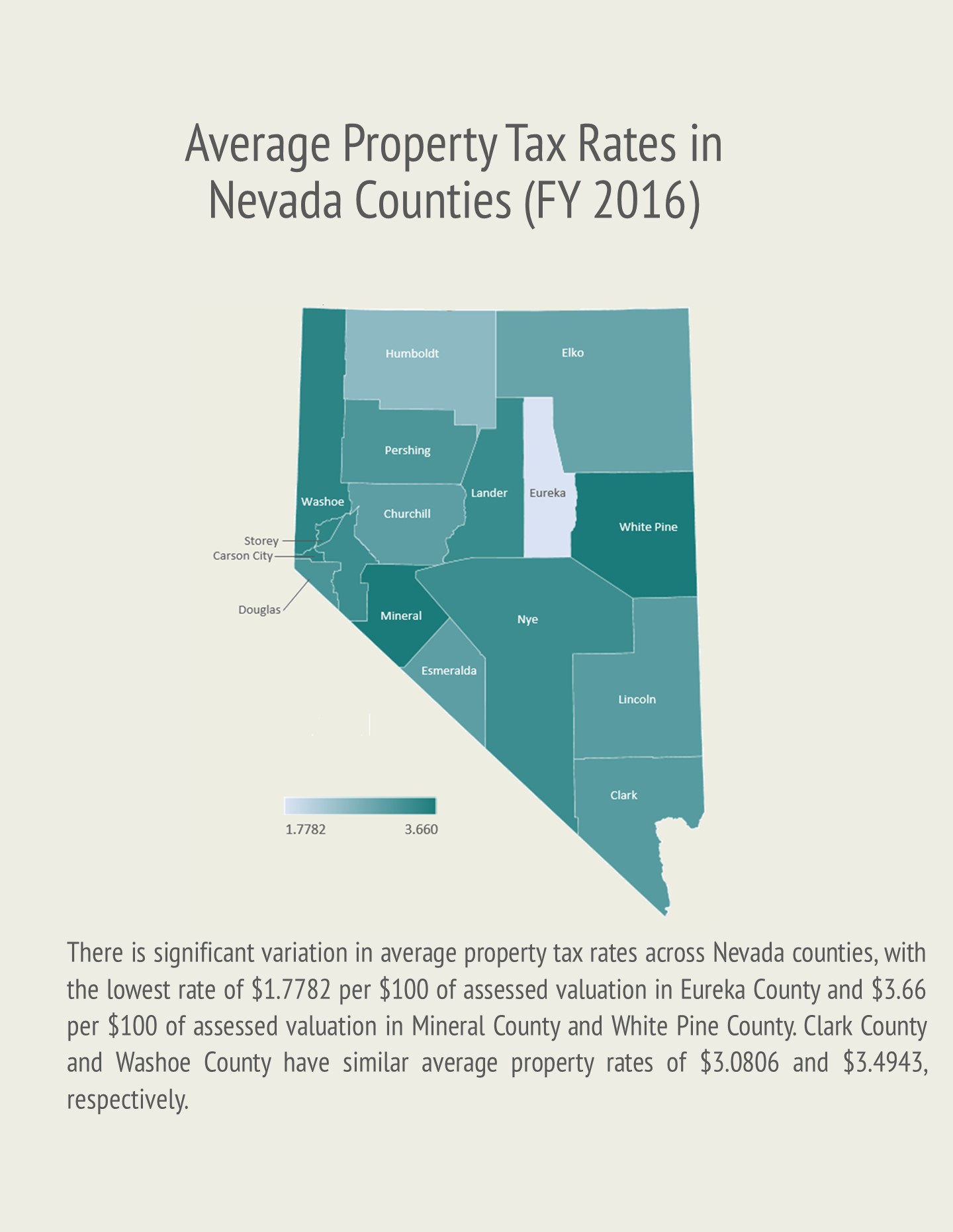

Property Taxes In Nevada Guinn Center For Policy Priorities

N J Now Has 2b In Property Tax Relief What You Need To Know And How To Get Your Rebates Nj Com

Murphy Announces Details Of Property Tax Relief Program Whyy

Deducting Property Taxes H R Block

Murphy Proposes New Direct Property Tax Relief Program New Jersey Monitor

Record High N J Budget With Property Tax Rebates Big Pension Money Tax Holidays Passes Legislature Nj Com

How Taxes On Property Owned In Another State Work For 2022

The Official Website Of City Of Union City Nj Tax Department

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

New Jersey To More Than Double Property Tax Relief To 2 Billion Bloomberg

Tax And Sewer Collector Hopewell Township Nj Official Website